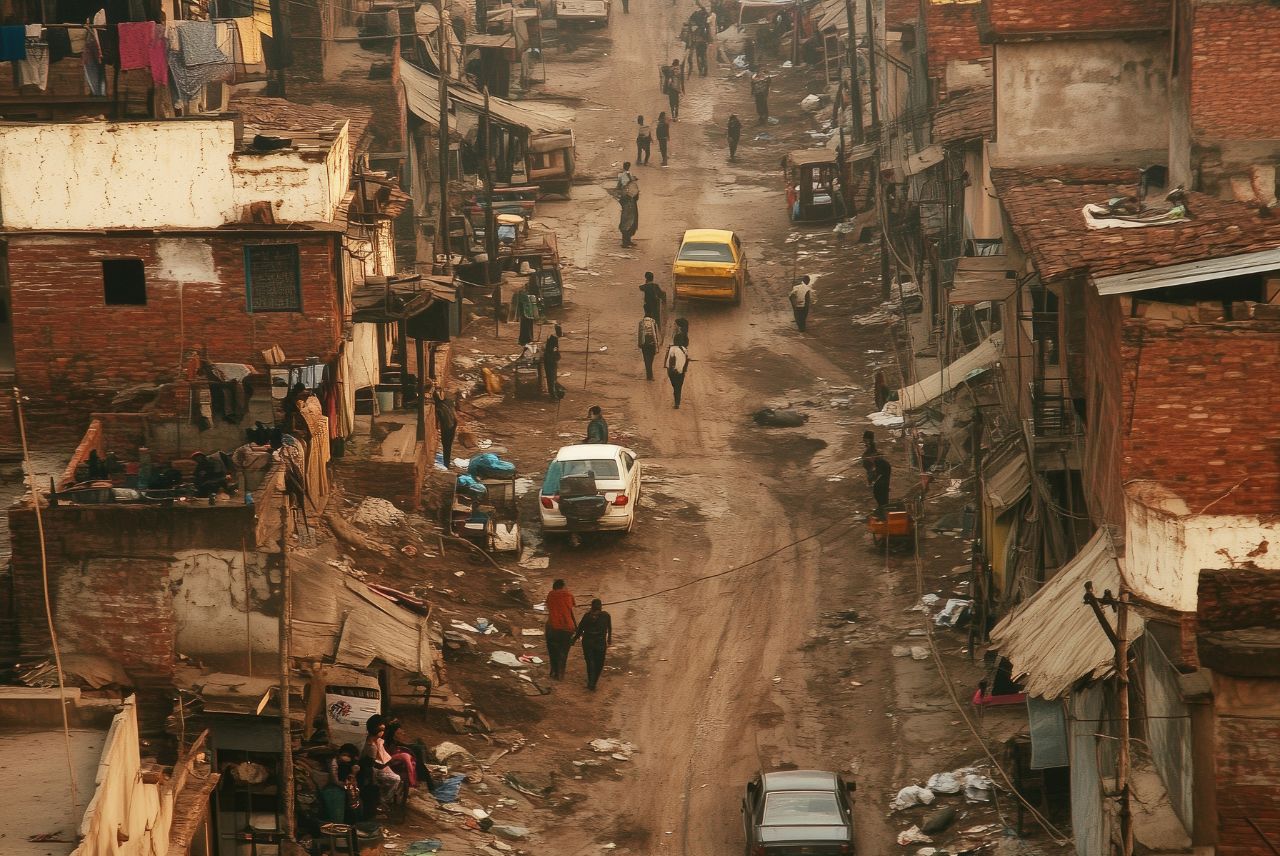

The Ulaanbaatar Green Affordable Housing and Resilient Urban Renewal Sector Project (AHURP) aims to transform the highly climate-vulnerable and heavily polluting peri-urban “ger” areas of Ulaanbaatar into low-carbon, climate-resilient, and affordable eco-districts. The project seeks to significantly reduce greenhouse gas emissions and air pollution, while enhancing the liveability, adaptive capacity, and climate resilience of Ulaanbaatar. A core component of the project is the establishment of a Sustainable Green Finance mechanism through the Eco-District Affordable Housing Fund (EDAF) to support green, inclusive, and climate-smart investments in the housing and urban renewal sectors.

Our Role:

We provided technical assistance for the Sustainable Green Finance Support (SCF) component of the AHURP, with a strong focus on enabling climate finance readiness, institutional development, system strengthening, and capacity building.

The engagement included the following key areas:

Phase 1-A: Establishment of EDAF

- Drafting policy and internal documents to operationalise the EcoDistrict Affordable Housing Fund (EDAF

- Developing guidelines to ensure a smooth and accountable flow of climate finance from EDAF to selected commercial banks

Phase 1-B: Project Implementation Support

- Providing institutional and operational support across financial and procurement systems to enable efficient deployment of climate finance

- Developing and regularly updating key internal policy documents (CAM, FAP, RMP, QACP) to align with climate finance standards

- Designing and implementing the EDAF Management Information System (EMIS) and monitoring frameworks (PPMS)

- Establishing robust quality assurance and control systems, risk management frameworks, and financial management tools

- Supporting procurement of climate-resilient goods, works, and equipment

- Ensuring environmental and social safeguards compliance, including preparation and reporting on gender and social action plans, ESG frameworks, and due diligence

- Conducting institutional and business process analyses and implementing targeted capacity development and training activities

Phase 2: Sector and Financial System Strengthening

- Supporting sector capacity development and policy reforms to integrate climate resilience and low-carbon development goals

- Developing and promoting green financial products (e.g., green mortgages, equity loans, securitisation instruments) aligned with climate finance frameworks

- Designing an investor outreach strategy and a sustainable green investment label to mobilise private sector participation in climate finance

- Developing standards, guidelines, and regulatory frameworks for green project qualification and selection to ensure climate finance alignment